Bookkeeper vs Accountant: whom should you hire for your small business?

In the world of finance, two roles often overlap and can be confused: bookkeeper vs accountant. Although both are integral to the successful management of financial records within a business, they serve distinct purposes and have differing levels of expertise.

Understanding the differences between bookkeepers and accountants might sound like something you’d only hear in a business meeting, but it’s more than just talk. It’s about making smart choices that help businesses keep their money in order and plan for the future.

Imagine you’re trying to build a complex puzzle. Bookkeepers are like those who sort and lay out the pieces, making sure everything is in order. Accountants are the puzzle-solvers, taking those pieces and creating the big picture.

Both roles are crucial, and knowing when to use one or the other can make a big difference in how a company runs.

This article is here to break down what bookkeepers and accountants do, showing how they’re both unique but also how they work together. We’ll dive into what they’re responsible for, the skills they need, and why they matter so much to a business.

Whether you’re a small business owner figuring out whom to hire, someone curious about how money works in the big world of business, or maybe even a student thinking about future careers, this guide is here to help.

So let’s take a quick tour through the world of numbers and plans that shape businesses every day.

No matter who you are, understanding this stuff can give you valuable insights and maybe even spark an interest in a career path you never considered before. It will also compare the roles of bookkeepers vs accountants.

Understanding Bookkeepers

You might have heard the words “bookkeeper” and “accountant” and thought they were playing the same tune. It’s kind of like mistaking the guitar for the bass; they might both have strings, and they might both be part of the band, but they play entirely different roles.

Over time, the jobs of bookkeepers and accountants have developed into two unique professions, like how the guitar and bass have their own sounds and styles in music.

Think of bookkeepers as the rhythm section, keeping the beat and laying down the foundation of the song. They make sure everything flows smoothly and on time.

Accountants, on the other hand, are like lead guitarists, adding complexity and depth, shaping the melody, and making sure the whole song comes together.

They might be part of the same band, but bookkeepers and accountants have unique roles and responsibilities, each contributing to the symphony of business in their own way.

Understanding this difference is like knowing your instruments in a band, and it can help a business hit all the right notes!

A Brief History of Bookkeeping

Bookkeeping, the careful recording of financial transactions, is a practice with roots stretching back to the dawn of civilization.

Ancient Mesopotamia and Egypt serve as examples of where this practice began, with early record-keepers using clay tablets as their medium.

Fast forward to Renaissance Italy, and the practice started to look more like the bookkeeping we know today.

Luca Pacioli, an Italian mathematician and a friend of Leonardo da Vinci, is credited with publishing the first text on double-entry bookkeeping in 1494. This system, involving the recording of both debits and credits, laid the groundwork for modern accounting.

The Industrial Revolution was a turning point that led to the further sophistication of the profession. Standardized practices emerged, along with more advanced tools, marking a significant step forward in the field’s development.

In the 20th century, the computerization of bookkeeping brought about a new era of accuracy and efficiency. This technological evolution transformed the way bookkeepers operated, making the process faster and more reliable.

Today, bookkeepers are a vital part of businesses both large and small, diligently maintaining records that are essential for financial analysis and strategic planning. Their role continues to adapt and evolve to meet the demands of modern business.

The journey from basic record-keeping on clay tablets to complex financial management using advanced software illustrates the ever-changing yet consistently significant role of bookkeeping.

The profession’s rich history reflects both the continuity of its core principles and its ability to adapt to the evolving needs of the economic landscape.

Role and Responsibilities

Bookkeepers are like the navigators of a company’s financial journey, meticulously charting the course of every monetary transaction.

Their role is foundational to the financial department, focusing on daily financial activities that keep the business on track. These frontline workers are tasked with:

- Recording financial transactions

- Managing the flow of invoices and payments

- Balancing bank statements, ensuring everything adds up

- Preparing internal snapshots of financial health through statements

- Handling payroll, the essential link between work and reward

- Navigating sales tax filings and various government reporting

In recent times, the role of the bookkeeper has evolved, with professional designated bookkeepers steering the ship in more complex and sophisticated directions.

No longer limited to basic record-keeping, they are taking on roles that mirror the strategic layers often associated with higher-level financial management.

Their increasing responsibilities reflect the growing complexity of the modern business landscape and the need for a professional touch that goes beyond mere numbers.

This shift in the role of the bookkeeper is like the progression from a traditional map to a cutting-edge GPS system, providing more precise and multi-dimensional guidance in the financial world.

This is an exciting era for bookkeeping professionals, with opportunities to contribute even more value to the businesses they serve.

Qualifications and Skills

In the past, bookkeepers were like craftsmen learning their trade through hands-on experience. A flair for numbers, an eye for detail, and a basic understanding of financial tools were the essential tools in their kit.

Formal education in accounting wasn’t a must-have for the bookkeepers of the past; it was more about practical skills and common sense.

But just like many fields that evolve with the times, bookkeeping has been experiencing a shift. Across the globe, bookkeepers have begun to see themselves not just as tradespeople but as professionals.

Bookkeepers are organizing, banding together to elevate their craft into a recognized profession. And that means aiming for more than just practical know-how.

These days, designated bookkeepers are like skilled artisans with a master’s touch. They’re reaching for higher levels of expertise through formal designations and ongoing education.

This new path brings bookkeepers more respect, more responsibility, and often, a more significant role in the financial life of the businesses they serve.

This transformation reflects a broader change in the world of work, where ongoing learning and professional development are becoming the norm.

It’s a sign that bookkeepers are not just keeping up with the times but actively shaping their future, turning what used to be seen as a job into a dynamic and respected career.

Technology and Tools

Gone are the old school days of bookkeepers surrounded by paper and pencils. Today’s bookkeepers are tech-savvy, harnessing tools like QuickBooks or Xero, and exploring apps for everything from document management to payroll.

This embrace of technology isn’t just about keeping up with trends; it’s a strategic move towards precision and efficiency.

Modern bookkeepers are leveraging digital tools to become vital financial strategists for businesses, guiding them through the complex landscapes of the contemporary economic world.

The digital transformation of bookkeeping is a new and exciting chapter, rich with possibilities and empowered by the tools of our age.

It’s a profound shift from traditional number-crunching to a dynamic profession, ready to meet the demands of today’s fast-paced business environment.

With this wave of innovation, bookkeeping has transformed into an ideal profession for the Digital Nomad lifestyle, marrying traditional financial wisdom with cutting-edge technology, and paving the way for success in a connected, globalized world.

Exploring Accountants

The rise of accountants from the practice of bookkeeping can be likened to the growth of a complex garden from simple roots. As businesses expanded and financial laws became more intricate, a new, specialized profession was required.

Bookkeepers continued to handle the daily transactions, much like tending to individual plants.

Meanwhile, accountants emerged to see the whole garden, considering long-term growth, navigating regulations, and planning strategically.

They started to specialize in areas like tax planning, auditing, or management accounting, each a unique facet of financial management.

The emergence of accountants was not an accidental development but a necessary evolution. It was driven by the increasing complexity of business operations and financial regulations, reflecting the demands and nuances of the modern business landscape.

It’s a tale of growth and adaptation, a natural progression from basic bookkeeping to the specialized field of accounting.

What’s Behind the Emergence of a Professional Accountant

In the past, as businesses grew and became more complex, they needed people who could do more than just keep track of money. They needed professionals who could understand and explain what the financial records meant.

This need led to the creation of what we now know as accountants. Unlike bookkeepers, who traditionally focused on recording daily transactions, accountants started to analyze and interpret those records. They became vital in helping businesses make informed financial decisions.

To make sure these accountants were skilled and trustworthy, special tests, rules, and organizations were created. Over time, the role of the accountant kept changing and growing.

Technology and important events in the business world shaped the profession, allowing accountants to focus on specialized areas like planning for the future of a business or making sure a company follows the law.

So, the job of an accountant has evolved over time, becoming more specialized and important. It’s a great example of how jobs can change to meet the needs of society and businesses.

Role and Responsibilities

Accountants work with the information collected by bookkeepers, ensuring that everything aligns with the laws and regulations, and helping the business meet its financial goals.

They look at the broader financial picture, understanding how to use numbers and data in a way that keeps the company on the right path, all while making sure they follow the rules.

Instead of just recording daily money movements, accountants focus on things like:

- Creating specialized financial statements that show how well the business is doing financially

- Planning for taxes and taking care of the necessary paperwork

- Checking the company’s financial information to make sure it’s accurate and follows the rules

- Helping the business decide what to do next with its money

While bookkeepers are focused on the daily details, accountants use those details to think about the future strategically and advise the business on important financial decisions. It’s like taking puzzle pieces and figuring out how they fit together to see the whole picture.

Qualifications and Skills

Accountants usually go to college or university and earn a degree in accounting or something closely related. That’s because their job requires them to know a lot about how money works and what the rules are.

Some even go a step further and get special certifications like becoming a Certified Public Accountant (CPA) or Chartered Accountant (CA). This is especially important if they wish to work in public practice.

Being an accountant means you need to be good at figuring things out and understanding complex rules. It’s not just about numbers; it’s about knowing tax laws and regulations that tell businesses how they can and can’t use their money.

Areas of Specialization

Accountants are like financial guides, specializing in different areas to help businesses with various needs. Some may become experts in forensic accounting, acting like detectives to solve financial mysteries.

Others might specialize in tax rules or management accounting, helping businesses make smart decisions with their money.

Each specialization is a unique path in the complex world of finance, tailored to different goals and challenges.

Tax Accounting

Specializing in tax accounting means focusing on laws, regulations, and compliance related to taxes.

Tax accountants guide individuals and businesses through the complex landscape of tax obligations, ensuring adherence to local, state, and federal laws.

They must stay up-to-date with ever-changing tax codes and may often need additional certifications or continuous education to maintain their expertise.

Management Accounting

Management accounting is like being a financial strategist for a business. Instead of just crunching numbers, management accountants team up with business leaders to plan for the future.

They look at what’s happening inside the company, helping with budgets, forecasts, and understanding how things are working. They’re all about using numbers to make smart decisions.

If you’re into business management or operations, this could be the perfect path for you in the accounting world.

Cost Accounting

A cost accountant focuses on analyzing, assessing, and managing the costs related to producing goods or services within a company.

Their responsibilities include analyzing costs, budgeting, setting prices, evaluating performance, ensuring compliance, supporting decision-making, and collaborating with other departments.

By providing detailed insights into cost structures, they play a crucial role in optimizing profitability and efficiency.

Cost accountants often work in manufacturing industries where understanding and controlling production costs are vital to the organization’s success.

Auditing

Auditors are like the financial watchdogs of the business world.

They take a close look at a company’s financial records to make sure everything is honest and up to code. Think of them as ensuring that the financial puzzle pieces fit together perfectly.

If they’re working inside the company, they might help find ways to do things better. If they’re from the outside, they provide a fresh, unbiased look at the numbers, giving investors and others the confidence to trust what they’re seeing.

In short, auditors make sure that a business’s financial story is told accurately, playing a crucial role in keeping things transparent and trustworthy.

Whether they’re spotting risks, finding errors, or suggesting improvements, their work helps everyone have faith in the financial world.

Forensic Accounting

Forensic accountants are like financial detectives.

They dive into the financial details of a business to look for anything that doesn’t add up, especially when there’s suspicion of fraud or other wrongdoing.

It’s not just about crunching numbers; they also need to understand the laws involved.

These specialized accountants might team up with police, lawyers, or other experts as they gather evidence that could be used in court. Because of this, they might need extra training in things like criminal law.

Their work goes way beyond basic accounting. It involves understanding specific laws, diving deep into financial mysteries, and sometimes even helping to build legal cases.

By focusing on this particular area, they can offer unique services and expertise, showcasing the diverse and ever-changing nature of the accounting field.

Whether it’s following the money in a criminal case or untangling complex financial webs, forensic accountants play a vital role in making sense of situations where numbers may be hiding the truth.

Bookkeeper vs Accountant: Comparison

Bookkeeper vs Accountant: how do these two roles differ from each other?

Bookkeepers and accountants both manage a business’s finances, but with distinct roles.

Bookkeepers handle daily records, while accountants analyze and strategize the bigger financial picture. Both are vital, but in unique ways. Let’s compare them.

Bookkeepers

Bookkeepers focus on recording everyday financial activities like tracking sales, expenses, and payroll within a company or organization.

They are responsible for ensuring that all financial information is correct, current, and organized, often using specialized software tailored to the company’s specific needs.

In today’s business environment, many bookkeepers pursue certifications or additional training to enhance their skills and competencies, as this can set them apart in a competitive job market.

While some small businesses or individual entrepreneurs might only need a bookkeeper with a basic understanding of accounting principles, many larger companies require more experienced professionals who can handle complex financial tasks.

Even with these variations in requirements and qualifications, the main role of bookkeeping remains consistent across different industries and company sizes.

It involves taking care of daily financial tasks, keeping accurate and detailed records, and preparing basic financial reports that give a snapshot of the company’s financial health.

This essential function of bookkeeping serves as the foundation for more advanced financial analysis and strategic planning carried out by accountants.

An important thing to keep in mind is that government bodies often mandate that even small businesses keep basic financial records. In fact, if you’re just starting out, this could be a crucial reason to consider hiring a bookkeeper.

Agencies like the Canada Revenue Agency, the Internal Revenue Service in the U.S. or the HMRC in the UK have specific guidelines and requirements for maintaining accurate books.

Adhering to these regulations is vital for maintaining your business’s integrity, and it also facilitates smoother financial management and planning.

Recognizing the importance of compliance from the very beginning, many small businesses choose to hire a bookkeeper right from the start. This ensures that all financial records are kept in line with the required standards, laying a solid foundation for future growth and success.

Accountants

Accountants work with more complex aspects of financial management, going beyond the daily record-keeping handled by bookkeepers.

They analyze the financial data, looking for patterns and insights that can guide strategic planning and big-picture decision-making within a business or organization.

Some typical responsibilities for accountants might include crafting budgets, making forecasts, evaluating potential financial risks, and making sure the company is following all relevant tax laws and other financial regulations.

In addition to these duties, accountants often provide advice on major business moves such as mergers or acquisitions and may specialize in areas like tax planning or financial auditing.

Their work requires in-depth knowledge and understanding, and many accountants pursue professional certifications such as becoming Certified Public Accountants (CPA) or members of the Association of Chartered Certified Accountants (ACCA).

These qualifications usually involve meeting specific educational and experience standards and ensure that accountants are well-prepared to align financial practices with a company’s long-term goals while maintaining compliance with laws and industry standards.

Their expertise turns the raw financial data into actionable insights that can help guide a business’s future.

The Synergy

Bookkeepers and accountants, although distinct in their roles and expertise, often work in tandem to achieve the financial goals of a business.

Together, bookkeepers and accountants create a well-rounded financial team for a business, with bookkeepers laying the groundwork and accountants building on that foundation to guide the company’s financial strategy.

Their combined efforts contribute to the overall financial stability, transparency, and direction of the organization. Whether working together or in clearly defined roles, they both play essential parts in maintaining the financial health of the company.

This table succinctly encapsulates the roles, responsibilities, and qualifications of bookkeepers and accountants, delineating the key differences between these two vital financial professions:

Scroll the table right & left to see it in full on your phone:

| Bookkeepers | Accountants | |

| Roles | – Daily Recording of Transactions – Organizing and Managing Data – Basic Internal Reporting – Payroll – Government Reporting – Sales Tax Filings – Collaboration with Accountants | – Higher-Level Analysis – Strategic Planning – Compliance and Regulation – Interpretation and Advising – Income Tax Filings |

| Responsibilities | – Accurate Record Keeping – Immediate Understanding of Financial Position | – Uncover Trends, Risks, Opportunities – Long-term Financial Strategy – Ensure Compliance with Laws |

| Qualifications | – Education: May not need formal education; some technical knowledge required – Certification: Possible certification through organizations like AIPB in the US or CPB in Canada | – Education: Bachelor’s or higher in financial accounting related field – Certification: CPA in Canada, CPA in the US, CA in the UK, or other professional designations |

Choosing Between a Bookkeeper vs an Accountant for Your Business

Small and large businesses alike need to pay careful attention to their financial management, but the extent and manner in which they engage bookkeepers and accountants can vary significantly based on their size, complexity, and specific needs.

Small Businesses

Small business owners often face the decision of whether or not to hire a bookkeeper vs an accountant, considering factors such as the complexity of financial transactions and the need for accurate record-keeping.

For small businesses operating with limited resources and relatively straightforward financial transactions, a bookkeeper may be sufficient for daily financial management.

These businesses often lean on bookkeepers to track sales, manage expenses, process payroll, and maintain accurate financial records.

Since small businesses may not require extensive financial analysis or strategic planning, a bookkeeper’s role becomes central to their day-to-day operations.

However, even small businesses must navigate complexities like tax laws and compliance requirements.

They may hire an accountant for periodic reviews, year-end financial summaries, or specific tasks such as tax preparation and filing.

Engaging an accountant in this way allows small businesses to benefit from specialized expertise when needed, without the cost of full-time employment.

Larger Businesses

As businesses expand and become more complex, so does their financial landscape.

In larger organizations, both bookkeepers and accountants might be employed, each playing specific yet interconnected roles.

Bookkeepers stay focused on the daily financial transactions, making sure that the information is consistently accurate.

They handle tasks such as tracking sales, expenses, and payroll, providing a clear and detailed record of the financial activities within the business.

Accountants, on the other hand, delve into more strategic aspects of financial management. Their work ensures that the business complies with all relevant laws and regulations.

In this way, bookkeepers and accountants work together in larger businesses, providing a well-rounded approach to financial management.

Bookkeepers lay the groundwork with meticulous record-keeping, while accountants build upon that foundation with in-depth analysis and strategic planning.

Their collaboration ensures that the financial needs of the organization are met comprehensively, supporting the broader goals and strategies of the business.

The Flexible Approach

The approach to financial management can vary widely among businesses, depending on their unique needs and circumstances.

Some might choose a more flexible route, hiring a bookkeeper for everyday financial tasks and then bringing in a specialized accounting firm or a CPA (Certified Public Accountant) for specific duties and occasional reviews.

This hybrid model allows businesses to tap into expert accounting services without having to commit to a full-time position, creating a balance of efficiency and expertise.

For small businesses, a bookkeeper might be enough to manage daily operations, but there are often situations where the specialized skills of an accountant are beneficial, such as during specific tasks or periodic financial reviews.

On the other hand, larger companies facing a multifaceted financial landscape may find it advantageous to employ both bookkeepers and accountants. In this setting, each professional contributes to different aspects of financial management.

Regardless of the size or type of the business, the collaboration between bookkeepers and accountants is essential. Whether in a small start-up or a large multinational corporation, this partnership reflects the complex nature of financial management.

By aligning financial practices with the business’s goals, size, and legal requirements, the combined efforts of bookkeepers and accountants contribute to a cohesive and effective approach to managing the financial health of the organization.

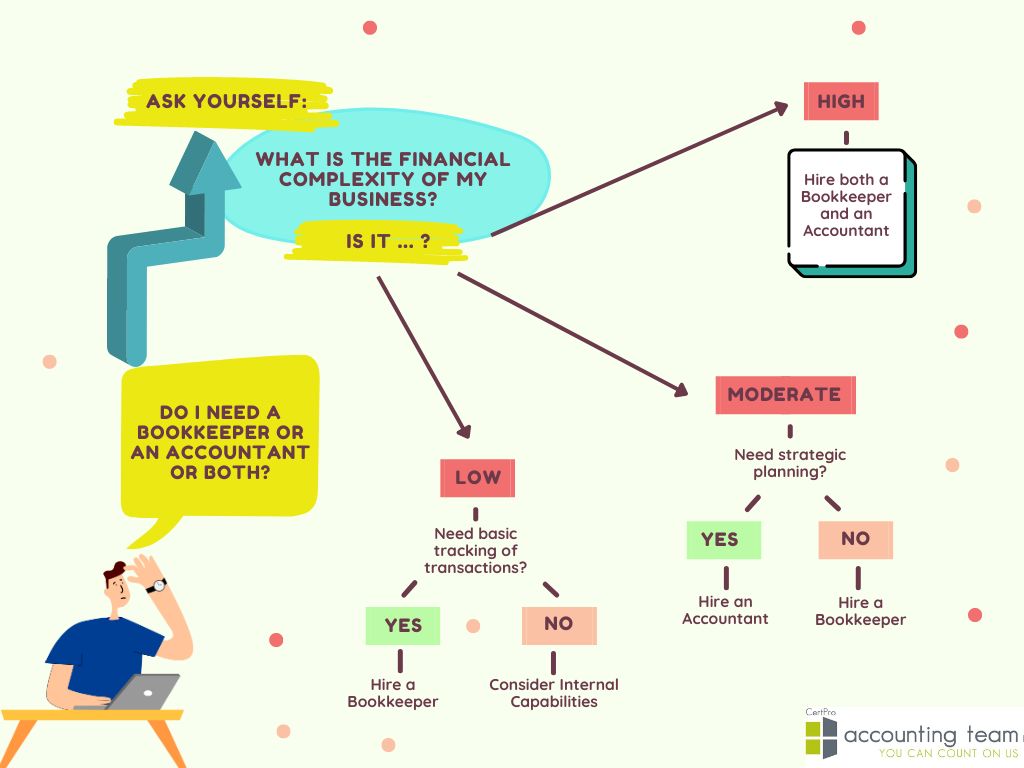

Here’s a simple guide for small business owners to help decide between hiring a bookkeeper, an accountant, or maybe both:

Conclusion and Summary

Bookkeeper vs Accountant: both are essential, yet distinct roles in financial management, each serving different purposes within the broader financial landscape of a business.

Bookkeepers are responsible for the daily tracking of financial transactions. Their efforts create the groundwork for precise and clear financial records.

Accountants, in contrast, analyze and interpret this data, moving beyond the immediacy of daily transactions to provide strategic insights.

The decision to employ a bookkeeper, an accountant, or both is not one-size-fits-all but depends on the size, complexity, and specific needs of a business.

Remember, it’s not just about numbers on a page; it’s about building a financial strategy that aligns with your goals and values.

The collaboration between bookkeepers and accountants could be the key to unlocking the potential of your business, guiding you toward a future filled with success and innovation.

Are you ready to decide whom to hire for your knowledge team? Will it be a bookkeeper, an accountant or perhaps your small business needs both?

FAQ Section:

What’s the primary difference between a bookkeeper and an accountant?

Bookkeepers focus on recording daily financial transactions and maintaining accurate financial records, while accountants analyze those records to provide insights for strategic planning, tax compliance, budgeting, and more.

Can a small business use just a bookkeeper, or do they need an accountant too?

It depends on the business’s needs. A small business may find a bookkeeper sufficient for daily operations, but may benefit from an accountant’s specialized skills for periodic reviews, taxes, or complex financial planning.

Do bookkeepers and accountants need different qualifications?

Yes, typically bookkeepers might have basic accounting education or certification, whereas accountants often have advanced degrees or professional certifications like CPA (Certified Public Accountant) or ACCA (Association of Chartered Certified Accountants).

Can one person perform both bookkeeping and accounting roles?

While it is possible for a single individual to perform both bookkeeping and accounting functions, especially in a small business setting, separating these roles can be advantageous. By having distinct professionals for each task, you can create an additional layer of oversight and compliance, which can help prevent fraud and enhance accuracy. This separation aligns with the best practices for financial management, allowing for clearer checks and balances within your organization’s financial operations.

What kind of software or tools do bookkeepers and accountants use?

Both professionals may use accounting software tailored to the company’s needs. Bookkeepers often use tools for tracking sales, expenses, and payroll, while accountants might use more advanced tools for data analysis, tax reporting, forecasting, and compliance.

How do I decide whether to hire a bookkeeper, an accountant, or both for my business?

Consider your business’s size, complexity, and specific financial needs. If you’re handling complex financial planning, taxes, or audits, an accountant might be necessary. For daily transactions and record-keeping, a bookkeeper may suffice. Many businesses benefit from a combination of both roles.

Can bookkeepers prepare tax returns, or should an accountant handle this?

While a bookkeeper may be able to assist with some tax preparation, an accountant with expertise in tax laws and regulations is generally better suited for this task. Accountants are trained to maximize tax efficiency and ensure full compliance with all relevant tax codes.